FinTech in Africa is set to explode for several compelling reasons, and her are a few of them:

Large unbanked population: Africa has a large unbanked population, with an estimated 350 million people who do not have access to formal financial services. FinTech companies can provide innovative solutions to this untapped market, enabling financial inclusion and economic growth.

Growing middle class: Africa’s middle class is growing, with an increasing number of people moving into urban areas and higher-paying jobs. This trend drives demand for financial products and services, creating a significant market opportunity for FinTech companies.

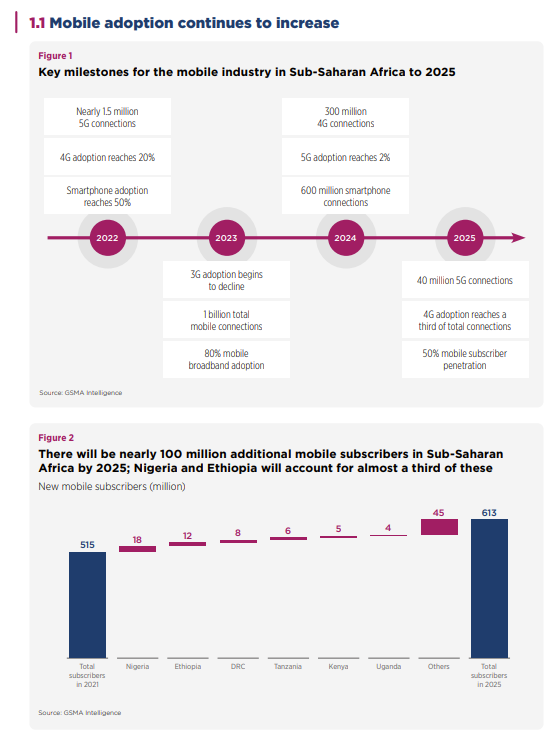

Mobile phone penetration: Africa has the highest mobile phone penetration rate in the world, with over 80% of the population having access to a mobile phone. This presents a massive opportunity for FinTech companies to leverage mobile technology to deliver financial services to the masses.

Limited traditional banking infrastructure: Many African countries need more traditional banking infrastructure, making it difficult for people to access financial services. FinTech companies can provide alternative solutions that are more accessible, affordable, and convenient.

Favourable regulatory environment: Many African governments actively encourage FinTech innovation and create a favourable regulatory environment to support the industry’s growth. This includes initiatives such as regulatory sandboxes, FinTech hubs, and tax incentives.

Strong economic growth: Africa has experienced strong economic growth in recent years, with many countries growing above the global average. This growth presents opportunities for FinTech companies to capitalise on the rising demand for financial services.

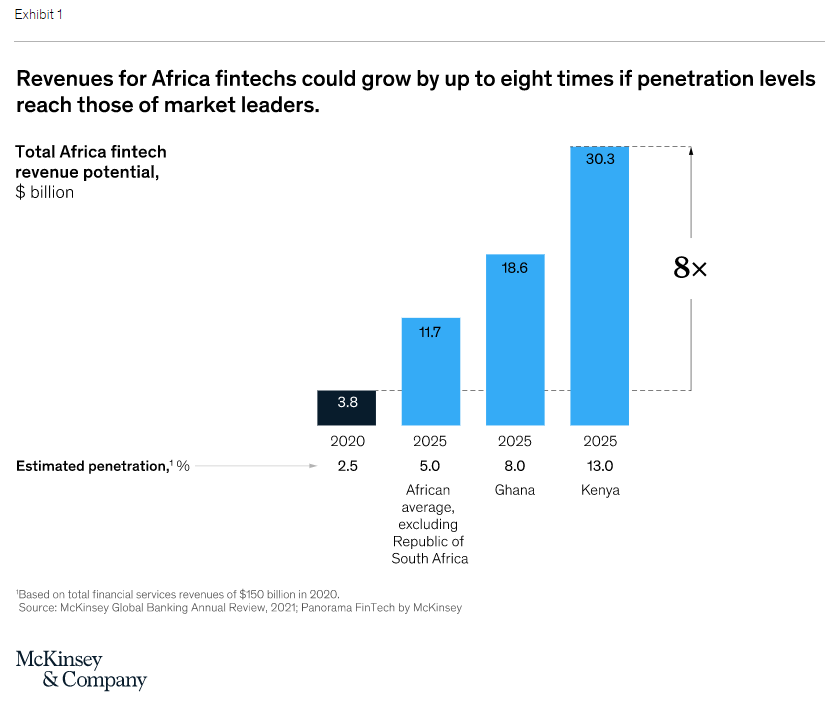

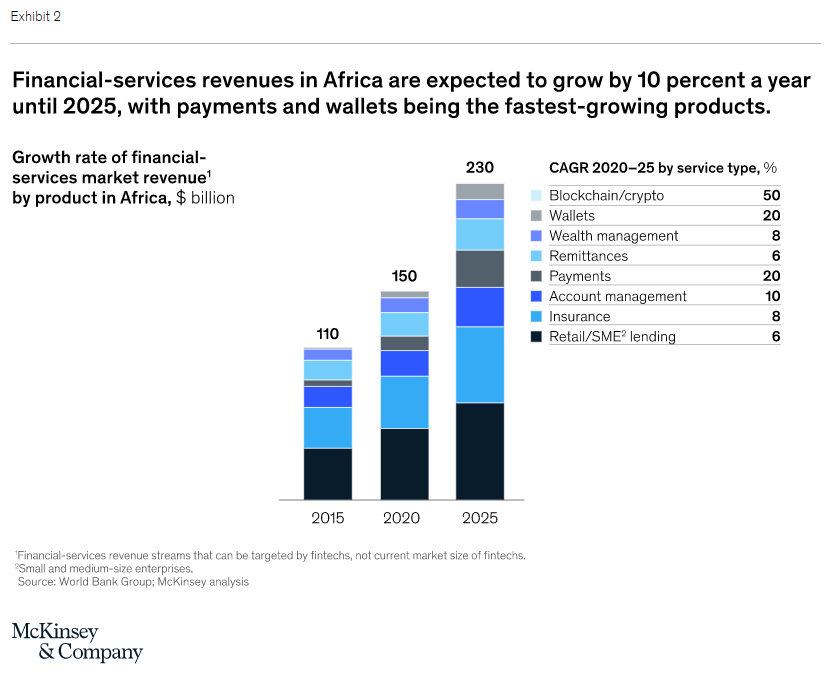

There is significant potential for investment in fintech in Africa. As cash is still used in around 90 percent of transactions in Africa, which means that fintech revenues have huge potential to grow. McKinsey estimate that African fintech revenues could reach eight times their current value by 2025 and analysis estimates that Africa’s financial-services market could grow at about 10 percent per annum, reaching about $230 billion in revenues by 2025 ($150 billion excluding South Africa, which is the largest and most mature market on the continent).

The African fintech space is growing exponentially, but the development of the fintech ecosystem is still in the early stages. While fintechs have made significant inroads in Africa—notably in wallets, payments, and distribution—there is still plenty of room for expansion. As the market matures, unique white spaces are identifiable in almost all areas of financial service.

With the rise of Mobile Economy in Africa, the Fintech sector is undoubtingly to grow tremendously. According to GSMA Intelligence, there will be nearly 1000 million additional mobile subscribers in Sub-Saharan Africa by 2025.